Competitive analysis of token launchpads on solana

In traditional finance (TradFi), when a company wants to expand into new markets, hire top talent, develop innovative technology or the likes but doesn’t have the funds to do so, it raises money. This can happen through venture capital (VC), friends and family, or even an initial public offering (IPO), depending on the company’s growth stage.

In the Web3 world, token launchpads serve a similar purpose. They help blockchain founders raise the capital they need to build and grow their projects much like what happens on Wall Street or in Silicon Valley, but with token sales instead of stocks.

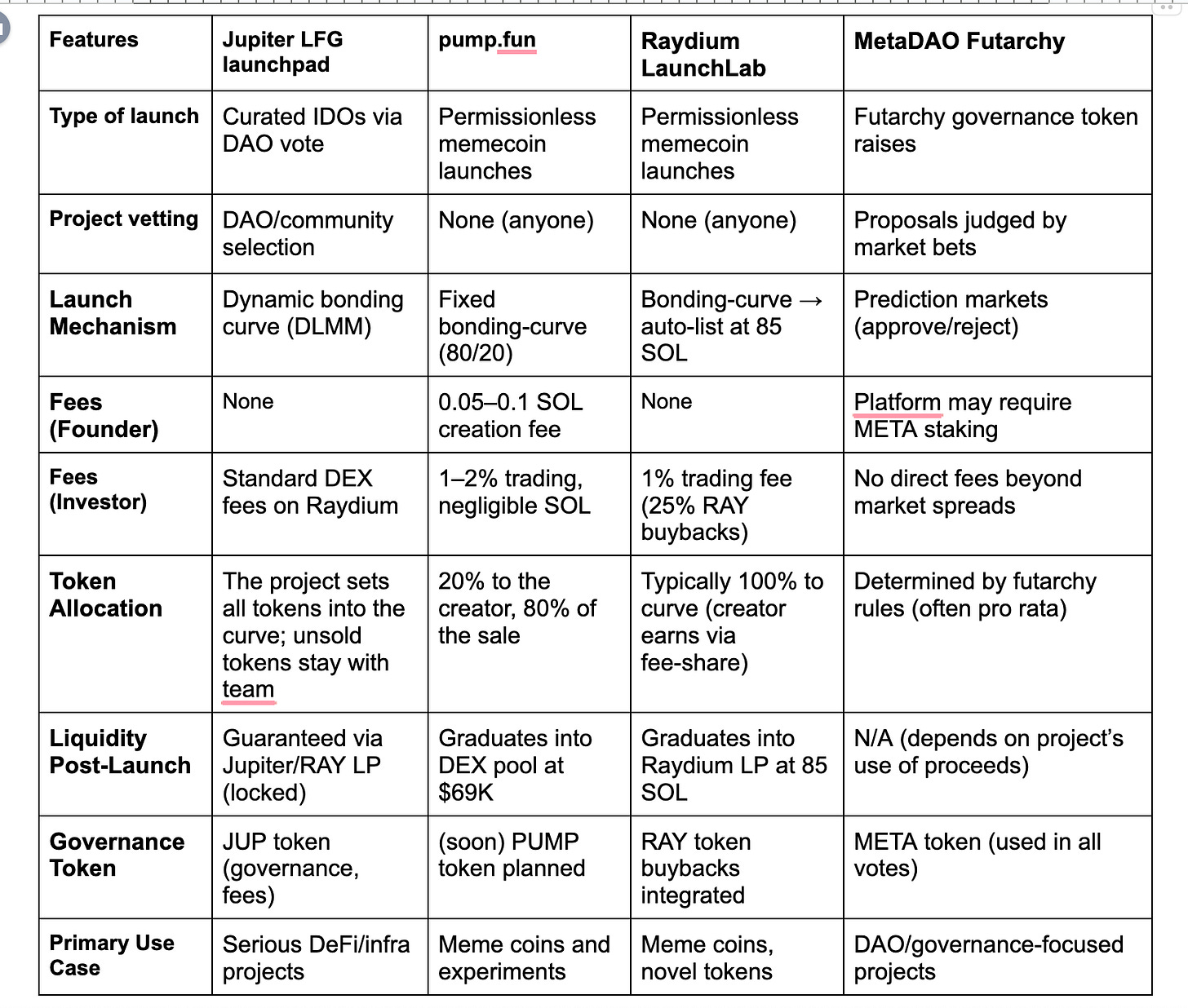

This deep dive explores four token launchpads on Solana and compares them based on features, strengths, and the types of projects, investors they attract.

Glossary

IDO (Initial DEX Offering): A way for crypto projects to raise funds by selling tokens on a decentralized exchange or launchpad, without a middleman.

Bonding Curve: A pricing model where the token price increases as more people buy it.

Rug-pull: A scam where a project suddenly disappears with investors' funds, usually after a token sale.

DLMM (Dynamic Liquidity Market Maker): A smarter version of an automated market maker (AMM) that adjusts liquidity to better manage price and risk.

Token Launchpads: Also known as crypto incubators, these are platforms that vet new projects, run token sales, and give early access to investors, often adding protections to avoid scams and sudden sell-offs.

Price-Curved Pool: A liquidity pool where token prices follow a curve instead of staying fixed, helping to balance demand and supply.

Backstop: A backstop in finance means a last-resort source of support or funding.

AMM (Automated Market Maker): A system that lets people trade crypto tokens directly with a pool of funds instead of through traditional order books.

Token launchpads

The idea of a token launchpad emerged as a response to the challenges and risks seen during the early days of ICOs (Initial Coin Offerings), which began in 2013.

During the 2017 boom, a lot of crypto ventures raised millions of dollars. ICOs allowed anyone to raise funds by selling tokens directly to the public, but they were plagued by security issues, scams, and a lack of investor protection.

This led to most people losing funds, the SEC in the U.S taking legal actions against most crypto firms and even having a hard deciding if coin offerings were securities. This led the SEC deeming 80% of ICOs as scams or failed projects.

Then came the launchpad model, which began to take shape around 2019, as the crypto industry sought safer, more organized, and community-driven ways to launch tokens.

One of the earliest and most influential launchpads was TrustSwap, which introduced features like token locks to protect investors and ensure project accountability. The launchpad concept gained significant momentum with the rise of DeFi and the introduction of Initial DEX Offerings (IDOs) on decentralized exchanges, which further leveled the playing field for early-stage crypto investments and improved transparency. Now we will look at prominent token launchpads on Solana.

Jupiter LFG launchpad:

Jupiter LFG is a community and DAO-driven launchpad built into the Jupiter ecosystem. It uses Meteora’s DLMM (Dynamic Liquidity Market Maker) mechanism to manage token launches, which offers full on-chain transparency and fairness. Jupiter emphasizes that its DLMM prevents price dumps, volatility, and eliminates bots and scams in token sales.

How it works

Projects propose token launches on the Jupiter research forum; they make their case to the DAO, citing what they intend to achieve.

Based on factors like community opinion, Catdet feedback, traction, TGE timeliness, and introduction quality, several candidates are then promoted to the candidacy stage. Each project will have a dedicated Discord forum thread where it may have a more private conversation with the DAO once it has advanced to the candidacy stage.

They will be immediately eligible to vote in the upcoming LFG Launchpad vote, provided they participate in an AMA with the JUP working group on any socials.

The DAO selects the two candidate projects that will launch in the upcoming month. Voting is always the first week of each month. Voting takes place via vote.jup.ag and lasts for three days. The $JUP staked token is used for voting.

Following the voting, the working groups will work with the Jupiter team and the accepted projects to schedule their launch dates.

In the selection process, large DeFi or infrastructure protocols are more prioritized and often pass this vetting; Jupiter’s statistics show past IDOs have focused on yield farming, staking (LSDfi), and bridge projects, each comprising about one-third of launches. This governance process means that quality and serious teams are prioritized, at the expense of quantity and speed (only 1-2 projects per month are approved).

Technically, Jupiter LFG allows a project to unilaterally deposit its token into a price-curved pool. Using DLMM, the project sets the price curve by range deposits, an example was Jupiter’s test launch, which deposited JUP tokens across a specific price range. Buyers purchase from the curve, with one-sided token deposits serving as a backstop, so each purchase mints SOL or a stablecoin to the project. DLMM’s features provide precise control: projects can define any bonding curve shape, and the system limits how many price ranges a single swap can cross, preventing any single bot from buying the entire pool at once. After launch, liquidity pool tokens (SOL + token) are locked for a configurable period to prevent immediate rug pulls. All trades and the entire process occur on-chain via Jupiter’s smart contracts.

Jupiter’s DLMM design prevents price dumps and volatility by dynamically adjusting prices and allocations, and it eliminates bots and scams through its range-based market-making.

Token Distribution and Fees: Jupiter LFG itself charges no launch fees to projects. The project retains unsold tokens after the sale, but buyers receive allocations strictly from the on-chain curve. Jupiter does earn revenue from trading fees on its DEX (where the token lists after launch), but the LFG launchpad is fee-free for the token issuer. By default, any unsold tokens or leftover liquidity can be set to go to the Jupiter DAO treasury or follow whatever the project planned. Projects keep the tokens they don’t sell, while SOL raised accumulates in the pool as LP tokens locked.

Founder Perspective: For founders, Jupiter LFG’s biggest advantages are trust and support. Being vetted by the JUP community can lend credibility and provide marketing as the launch is announced on Jupiter’s social channels. The one-sided deposit with DLMM means teams control pricing and liquidity directly. The platform’s strong anti-bot, anti-rug features reduce investor fear, potentially attracting more diligent investors. Moreover, there are no direct fees or fixed royalties.

The disadvantages are higher barriers and a slower process. Projects must pass DAO approval which can be time-consuming and uncertain, and only two launch slots are available. Founders must also integrate into the Jupiter ecosystem, e.g., use the Jupiter exchange and stick to Jupiter's requirements, e.g, LP locking rules. This suits established or ambitious teams, but isn’t ideal for very early or experimental tokens.

Investor Perspective: Investors on Jupiter LFG benefit from fair launches. Everyone can buy at the same price from the on-chain pool, with no private sales or pre-seed allocations. The DLMM design ensures continuous liquidity and less post-launch crashing, i.e, rug pulling. Jupiter’s vetting adds confidence in project quality. On the downside, purchases are still speculative. Investors also depend on JUP governance; those wishing to influence project selection must stake JUP.

Pump.fun Memecoin Launchpad

Pump.fun is a permissionless memecoin launchpad on Solana launched in 2024. Its slogan is fair launch for anyone means any wallet and anyone can instantly create a new SPL token via a simple interface. They upload an icon and name, pay a tiny SOL fee, and a 1 billion-token supply is created. 800 million (80%) of that supply is auto-allocated to a bonding curve sale, and the remaining 200 million (20%) go directly to the creator’s wallet. Early buyers can invest directly in the curve for very cheap initial prices, then as more buyers purchase, the bonding curve price automatically rises.

Once a token market cap hits 69,000 USDC, roughly 85 SOL, it graduates from Pump.fun, and the SOL accumulated is used to create a real AMM liquidity pool on Pump.fun’s DEX (PumpSwap) or other DEX (like Raydium). After graduation, trading shifts to the pool, and the token is effectively live on a DEX. There are no whitelisted stages or private sales. Token launches are fully fair and on-chain.

Founder perspective: For founders, Pump.fun’s advantage is speed and reach. It takes minutes to launch any meme token without a legal or vetting process. Many projects in just the last year have leveraged Pump.fun, producing viral hits from dog-themed coins to political tokens. There are no launch fees beyond the SOL contract cost, and no need to prepare contracts or liquidity manually. However, the disadvantages are extreme risk and short-lived hype. Because anyone can launch a token, the space is flooded with low-quality or outright fraudulent tokens. Values can go up crazily for no reason and crash just as fast. Founders have little to no protection, once the bonding curve ends, even the 20% team tokens could be dumped (nothing legally stops them). Pump.fun itself faced turmoil. A rogue insider drained about $2 million from the protocol in late 2024. This showed its reputational and security risk but since then Pump.fun ramped up audits and security incentives, but founders must remember their creation instantly competes in a jungle. Pump.fun’s model effectively rugs many projects post-launch, so only those ready for short-term craze will tolerate it. Also, other individuals are likely to launch token projects with the same name, logo, and official links, claiming to be you. Founders should always announce their token contract address to their community.

Founders have to promote their token on social media.

Investor perspective: Pump.fun appeals to risk-tolerant speculators. The upside is huge, some coins have soared 10-100x in hours, riding FOMO and social buzz. The fully on-chain bonding curve offers instant liquidity, and investors can buy/sell from day zero. Trading fees are low, and Solana’s tiny network fees make small trades cheap. On the flip side, almost every token is a gamble. There is no vetting, no KYC, no refunds. Smart contract code is open-source, and past events showed that even insiders can manipulate things. Post-graduation, liquidity can vanish, or founders may dump tokens. The flood of tokens every second also makes UX chaotic: investors must search through dozens of launches daily, many of which disappear in minutes. Hence, prompting many to seek and know the exact contract addresses of project tokens.

Founder Fit: Trend-driven communities, artists, or any team chasing viral appeal might use Pump.fun to quickly test a meme.

Investor Fit: Speculators seeking early access to lightning-fast memecoin launches; those comfortable with extremely high risk and volatility.

Raydium LaunchLab

Raydium’s LaunchLab, launched in April 2025, is a direct response to the Pump.fun craze, but backed by its AMM (Raydium). Like Pump.fun, LaunchLab uses bonding curves for token creation, but with Raydium’s flavor. Any user can no-code launch a token for free: the entire supply is deposited into a customizable curve pool on Solana. Raydium sets a graduation threshold of 85 SOL. Once a token’s raised SOL hits this, Raydium automatically graduates the token by migrating liquidity to a Raydium AMM pool.

Creators can choose to lock 10% of LP tokens for themselves earning 10% of future trading fees via a burn-and-earn program; otherwise, Raydium burns 100% of LP tokens. Trading fees on the pool are 1%, with 25% of those fees used for RAY token buybacks.

Founder’s perspective: LaunchLab’s founder's advantages follow those of Pump.fun’s free, immediate launch but adds some Raydium benefits. Creators get Raydium’s branding and community reach. The integration means there are no external migration hurdles; tokens automatically list on Raydium’s AMM immediately post-graduation. There are no coding requirements or stake-in-system needed. The option to claim 10% of fees post-launch also aligns incentives, founders earn as their token trades.

The disadvantages are that it’s still a memecoin platform, so projects face hype-cycle volatility and minimal vetting. Free launches mean low entry cost but also intense competition for buyer attention. If a token never hits 85 SOL, it will stay only on the curve with no pool, limiting trading beyond LaunchLab.

Investor’s perspective: LaunchLab offers a smoother Raydium experience. Early buyers can access new tokens directly through Raydium’s UI. There are no migration fees. The token supply and curve operate like Pump.fun’s e.g., immediate liquidity via the curve. Investors gain confidence that successful projects will be supported by Raydium’s deep liquidity. However, LaunchLab tokens are still highly speculative. They carry all memecoin risk, and Raydium cautions that LaunchLab targets memecoin enthusiasts. The optional creator fee share means a portion of profits flows to token creators, but 90% of fees still go back to the pool and platform.

Performance: Although brand-new, LaunchLab tokens have quickly hit the threshold, confirming demand. Raydium notes ~10 tokens have already exceeded 85 SOL. The RAY token even spiked ~14% on the news. While initial traction is strong (a reflection of the memecoin craze, the long-term ecosystem impact remains to be seen. LaunchLab’s approach essentially channels pump.fun’s hype through Raydium’s infrastructure, aiming to “dethrone” Pump.fun as Solana’s leading meme launchpad.

Founder Fit: Creators of fun or novelty tokens who want Raydium’s on-chain liquidity and reputation without fees.

Investor Fit: Traders chasing new Raydium-listed tokens from day one, with 1% fees for liquidity depth.

MetaDAO Futarchy Launchpad

MetaDAO is totally different. It is not just a bonding-curve launchpad but a governance protocol using futarchy (prediction markets). MetaDAO’s launchpad approach uses markets, not votes. Projects submit proposals, and two prediction markets (approve/reject) are created. MetaDAO token holders trade these outcome tokens, and proposals pass when the market predicts they will raise META’s value.

How project launch tokens

Projects that want to launch via MetaDAO present a proposal with success metrics, e.g., target token performance, minimum USDC funding required.

MetaDAO community members contribute USDC to projects they want

The project only gets launched when it hits its target, else everyone who invested gets their USDC back

Once funding is met, 10,000,000 tokens are distributed proportionally among everyone who contributed USDC. 10% of the USDC and an additional 1,000,000 tokens are deposited into a liquidity pool for decentralized trading.

A MetaDAO's DAO treasury, controlled through futarchy, is created to govern proposals made by the project, transferring the liquidity position, the remaining USDC, and the ability to mint new tokens.

All processes are fully on-chain and transparent. Decisions are made through on-chain markets, with financial stakes behind every prediction.

MetaDAO’s platform itself and any participating DAOs operate under this futarchy framework.

For founders, the advantages are aligned incentives and meritocracy. A project is only funded if a community of METAs holders (the market) believes in it. This eliminates gatekeepers; there is no private allocation, and supporters have skin in the game via predictions. It effectively guarantees a built-in investor base that wants the project to succeed. MetaDAO’s design means eligible projects can access capital and community before any token is minted, solving the classic chicken-and-egg problem of fundraising.

The disadvantages are that futarchy is unproven and complex. Projects must articulate clear, measurable success goals. If the prediction market is thin (low liquidity), whales could sway outcomes. And since the platform is new (its first big sale, MTN Capital, happened in early 2025), its track record is very limited. Investors on MetaDAO behave like traders. Their advantage is profit from predictions: if you accurately foresee a project’s success, you earn META tokens and trading gains.

The process is transparent and verifiable, every decision and result is on-chain. There’s no FUD or hype cycle in governance. It’s a prediction market, so decisions may be more rational. The downside is as a typical investor, you need to understand futarchy markets, which are more complicated than regular token trading. Liquidity for governance votes can be thin initially, and the model itself may not suit short-term flipping. In effect, MetaDAO’s launchpad is for the crypto governance purist: those who view token sales as speculative governance questions. It rewards long-term aligned supporters, but may deter general investors seeking 10-100x.

MetaDAO’s launchpad is currently permissioned (by experiment) has to go through a team for vetting, designed to let projects raise capital and build a community before their token exists effectively launching as a Futarchy from day one. It aims to solve the capital-trust issue by having the community’s bets determine which projects get funded.

Founder Fit: DAO-oriented teams or experimental projects valuing decentralized trust. Also, teams that want community backing before launch.

Investor Fit: Those comfortable trading prediction markets, aligned with novel governance; crypto analysts who want to bet on project success.

Platform Risks and Protections

Jupiter LFG: The platform’s protections are very strong by design. The DLMM algorithm automatically caps bot buys and locks liquidity, preventing sudden dumps. All mechanics are on-chain and auditable, eliminating the black-box. The main risk is the relative novelty of DLMM (audit any code weaknesses) and dependence on the DAO vote process (governance attack possible, though unlikely with staked JUP). Unlike permissionless launchpads, Jupiter’s vetting makes outright scam projects far less likely.

Pump.fun: Pump.fun offers no built-in safeguards beyond its bonding curve. While liquidity is locked during the curve sale, once graduated, the team that created the token can drain the pool, and also, many tokens have rapidly failed post-launch. Indeed, Pump.fun’s own $PUMP token sale revealed internal security flaws – a disgruntled employee once drained ~$2M from the contract in protest. Users must trust that the code is solid (Pump.fun has encouraged audits with rewards) and that founders won’t exit-scam post-launch. The platform explicitly warns of rug pull risk after graduation. Moreover, regulatory risk looms; projects like the Official TRUMP token on Pump.fun have caught media and possibly SEC attention for spoofing celebrity names. In summary, Pump.fun’s risk is highest. Open participation means anyone can launch a scam token at any time.

Raydium LaunchLab: As a Raydium-run protocol, LaunchLab benefits from Raydium’s established codebase and bug bounty programs. The bonding curve model still leaves a window for volatility, but since liquidity is migrated into Raydium’s AMM with no fees, the risk of rugpull is reduced (Raydium “burns” 90% of LP tokens for simplicity, 10% optional for founders). Raydium’s team audits and oversight make large exploits unlikely. However, since memecoin launches are its primary focus, the market risk remains comparable to that of Pump.fun. If a LaunchLab token never reaches the threshold, it remains untraded; if it does, investors must still be wary of post-listing dumps. In short, LaunchLab is safer than Pump.fun code-wise, but investors should still expect extreme swings.

MetaDAO: All voting and token allocation on MetaDAO are on-chain, with no central authority. That means transparency is total, every forecast and allocation is recorded. The risk lies in the mechanism: thin prediction markets can be manipulated, and the futarchy model is untested at scale. For now, the launchpad is permissioned by MetaDAO proposal to avoid adversarial attacks during rollout. In the future, permissionless operation could introduce scams if dishonest proposals succeed. Overall, MetaDAO’s approach is safer from founder rugging because funding is conditioned on market predictions, but it places the burden on participants to understand the scheme. There is also project risk. If a funded project fails, investors lose regardless of the platform.

Conclusion

No single launchpad fits all. Jupiter’s LFG appeals to serious projects seeking a fair, community-endorsed launch with strong liquidity but accepts the overhead of governance. Pump.fun and Raydium’s LaunchLab empower rapid, all-access launches, ideal for viral meme tokens but ridden with risk. MetaDAO offers a futuristic governance path, where funding is voted on by market bets, aligning incentives at the cost of novelty and scale.

Founders must weigh these differences: Do they want speed and hype (Pump.fun/Raydium) or vetting and price stability (Jupiter), or are they pioneering DAO-aligned fundraising (MetaDAO)? Also, investors decide between maximum upside (meme tokens), confidence in curation (Jupiter), or betting on governance outcomes (MetaDAO). Platform-level protections vary accordingly: from Jupiter’s anti-bot DLMM and locked liquidity, to Pump.fun’s open-but-exposed curve, to Raydium’s trusted DEX integration, to MetaDAO’s fully on-chain markets.

Each platform cultivates a different community of builders: large Defi protocols often favor Jupiter LFG; small teams and influencers chasing virality move towards Pump.fun/LaunchLab; while DAO-native teams may experiment with MetaDAO’s futarchy. Founders should choose the launchpad matching their fundraising style and target audience, and investors should pick platforms aligned with their risk appetite and trust model.

Reference

The Building Block of Jupiter’s LFG Launchpad

LFG Launchpad: From application to the LFG Launch!

Raydium debuts LaunchLab to rival memecoin maker Pump.fun

DWF Ventures publishes analysis of Pump.fun token sale

Solana Meme Coin Launchpad Pump.fun Debuts PumpSwap Exchange

Jupiter LFG Launchpad: A Game-Changer for Solana Projects in 2025