Earn passive income validating transactions

Validator, staking SOL and why you should do it

New to crypto, you’re about to learn how you can earn passive income by staking with a blockchain validator.

What are validators?

Just as auditors verify a company's financial transactions to ensure accuracy and make sure no malicious activities have been going on, validators check and confirm blockchain transactions to maintain trust and integrity in the system.

Validators makes sure transactions are accurate and valid before adding to the blockchain. They also guard against fraudulent activities.

Staking

Staking is a way for you to partake in validating blockchain transactions while earning rewards doing so. Much like how we put our money in the bank using fixed deposits for a period and earn interest overtime. Staking is locking up your crypto funds for a period of time and earning additional tokens.

The video below shows why you should stake your crypto.

All this is done through a validator when you delegate your crypto for staking with them.

How to stake your crypto

For this example, I’ll be showing you how to stake your SOL and what to look out for when choosing a validator (I’ll be using Greed validator as an example)

Step 1: Install a crypto wallet, e.g phantom & deposit SOL

Step 2: Click on the Solana token balance in your wallet

Step 3: Click the "Start earning SOL" button

Step 4: Pick a validator to stake with.

Choosing the right validator matters because it determines what rewards you get when you stake your SOL. Use the search bar to check out various validators.

Key things to look out for when choosing a validator as a newbie

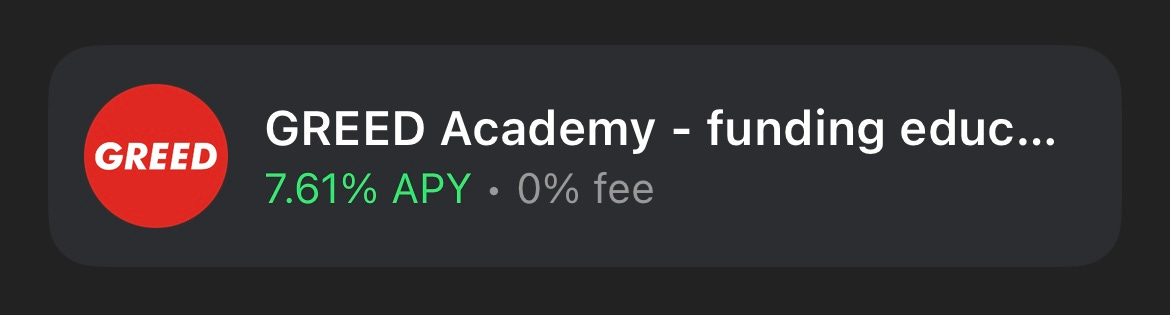

Annual Percentage Yield (APY): this reflects the potential return on your staked SOL. Compare APYs across validators to find competitive rates, typically around 6–11.67%

Commission fee: some validators charge a percentage of the rewards as a fee. Higher fees can significantly reduce your earnings. For instance, a 10% commission means you keep 90% of your rewards and the validator keeps 10%. A 0% commission fee means you keep 100% of the rewards.

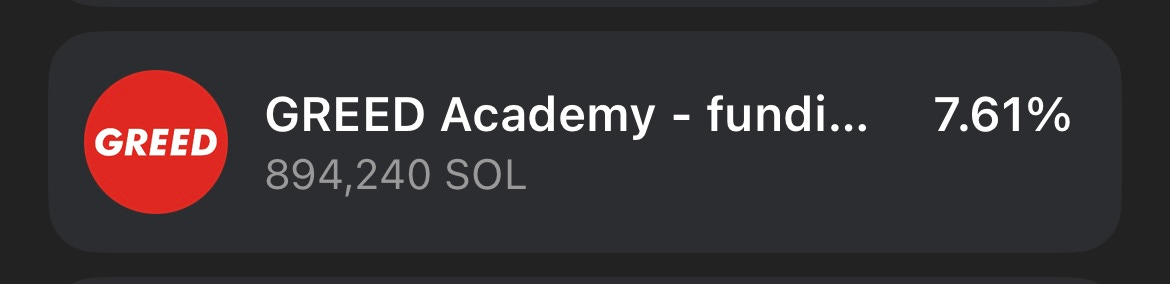

Total Sol staked: in the image above, total Sol staked is 894240. A validator with a large stake indicates trust and reliability because many users have delegated their tokens to it, trust the validator to perform. It also reflects the validator's commitment to its obligation and they pass more rewards to stakers.

Step 5: Follow the platform’s instructions to stake your tokens. This usually involves selecting the amount to stake and confirming the transaction.

Pros and cons of staking

Pros

Consistent Passive Income: Similar to earning interest in a savings account. By staking assets, you receive rewards, often in the form of additional tokens, for simply locking your funds and supporting the network.

Higher returns: Staking offers better returns than traditional investment options, making it an appealing option for growing your investment.

Compounding Rewards: When you earn rewards from staking, those rewards can be reinvested or staked again, leading to compounding benefits. This means that over time, your total amount staked can grow significantly as you earn rewards on both your initial investment and any additional tokens received.

Network Security: Enhances blockchain stability by ensuring honest transaction validation

Cons

Lock up: If you commit to staking for a specific duration, you may not be able to access those funds until the staking period ends. Depending on the duration of the staking period, you can’t sell or trade your crypto.

Waiting period: when unstaking, funds aren't immediately made available. It takes about 2–3 days for the funds to be made available in your wallet.

Crypto price volatility: When prices fall, the value of accumulated rewards also decreases, which can reduce expected gains or even lead to losses.

Platform Risk: There is always a risk associated with the platform or validator you choose for staking. If the platform is hacked or fails for any reason, you could lose your staked assets. It's crucial to do thorough research and select reputable validators or platforms.

For further inquiry picking a good validator, use tools like stakewiz.com. Check for validators with a strong track record of uptime and low skip rate as this indicates reliability in processing transactions.