Stablebonds as collateral in DeFi

Everything you need to know about stablebonds as financial instruments in the DeFi space

Cryptocurrency was created to make money and payments universally accessible. Give everyone a level playing field for investments without barriers. DeFi (Decentralized Finance), which combined various financial services including trade, insurance, savings, and loans, made this even more feasible and has continued to evolve rapidly in 2024, primarily establishing a robust ecosystem for lending and borrowing that significantly diverges from traditional financial systems.

Now, without any intermediaries and paperwork, individuals can acquire loans against their cryptocurrencies for various purposes.

This paper seeks to introduce its reader to lending and borrowing in traditional finance and decentralized finance. It also educates on what government bonds are, then moves towards what stablebonds entail, how etherfuse is making investing in RWA stablebonds possible, and how they can be used as collateral to improve DeFi lending and borrowing. It also assumes the reader has some knowledge about the investment market and crypto.

Market Context

Government bonds

Bonds have been around for centuries. The first recorded bond issuance dates back to 2400 BC in Mesopotamia, specifically from a stone tablet discovered in Nippur, modern-day Iraq. This artifact represented a surety bond, which guaranteed the payment of grain. In this context, grain served as the currency, and the bond ensured reimbursement if the principal failed to fulfil their payment obligation.

These early bonds were crucial for facilitating trade and credit in an economy reliant on agricultural output. The system allowed individuals to secure loans against future harvests, reflecting an early form of structured finance that would evolve over millennia into the complex bond markets we see today.

In today's world, government bonds are financial instruments that enable governments to raise capital and an investment strategy where individuals loan money to the government in return to receive a series of interest payments at specified dates, and at the expiry date of the bond, the individual gets refunded his/her initial investment.

Say a government wants to construct a new school, hospital or infrastructure in a state. They don’t have enough funds to do so; the government can borrow money from its citizens to build such amenities and infrastructure. In return, the government makes a fixed payment of interest at interval specified by the bonds coupons (interest rate). These payments continues until the bonds maturity or expiry date. When they do expire, individuals who bought the bonds get their initial invested sum back. The maturity date can range from less than a year to 30 years.

The first ever issued government bond was issued by the Bank of England in 1693 to raise money to fund its war against France.

Because of their low volatility and predictable returns, bonds are a safe investment, especially for risk-averse individuals. Offering a fixed income for its holders.

Stablebonds

Stablebonds are tokenized real-world assets (RWAs) backed by government-issued bonds from stable economies such as the USA, Mexico, and the European Union, ensuring a high level of security and trust for investors.

They are a new financial product introduced by Etherfuse, designed to combine the stability of government bonds with the advantages of blockchain technology.

Etherfuse simply purchases and holds government bonds, then issues Stablebond tokens to each of its bond holders and destroys the Stablebond tokens on its maturity.

These products allow for seamless investment in government-backed assets on the blockchain without an intermediary, e.g., banks, also offering interest of up to 9% APY. These interest rates are adjusted weekly to stay competitive.

Stablebonds democratize access to bond investments, allowing retail investors to participate with smaller amounts, thus broadening the market beyond traditional high-net-worth individuals. Currently Etherfuse has four stablebonds, which anyone can buy.

US Stablebonds (USTRY) are US Treasury Notes backed by the full faith and credit of the US government with a 5% APY.

Mexico Stablebonds (CETES) with a 9% APY are Mexico's oldest short-term debt securities issued by the Ministry of Finance. They play crucial roles in the financial system, serving purposes such as government financing, influencing monetary policy, and providing a safe investment option.

UK Stablebonds (GILTS), which is a collection of UK Government liability with a 3% APY,

Europe Stablebonds (EUROB), which are a collection of fixed-income securities issued by countries in the European Union with a 2.5% APY.

More stablebonds are expected to be launched on the platform soon.

The current lending and borrowing market in tradFi and DeFi

To understand how stablebonds will be of benefit when used as collateral in DeFi, we need to examine the current system in place.

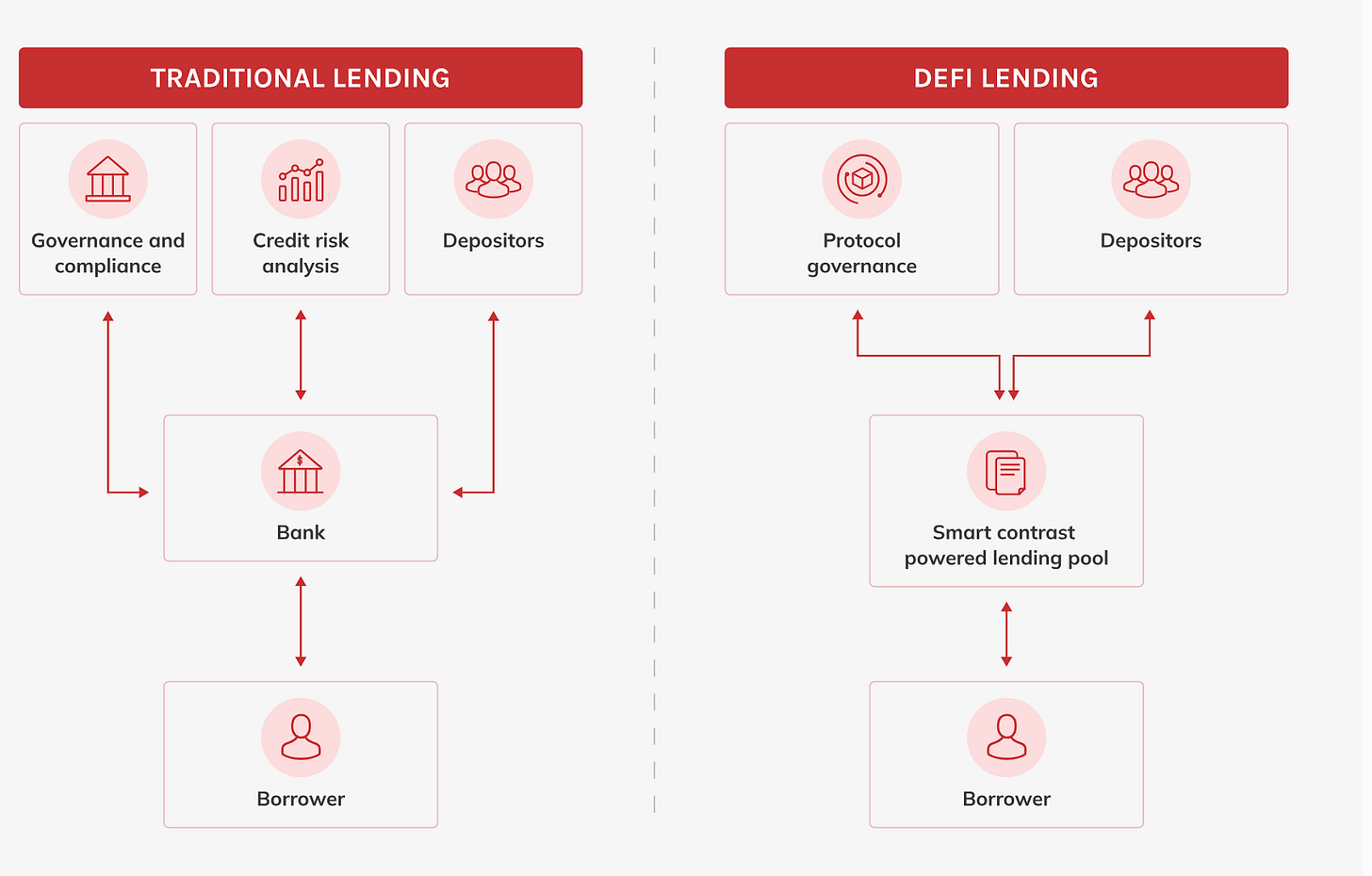

In traditional finance (tradFi), when a businessman goes to the bank for a loan, he is asked for collateral to secure the loan. This collateral is a valuable asset owned by the businessman, which can be a building, a land, etc. This is to ensure that the businessman has a compelling reason to keep up with his financial obligations, and if he defaults on the loan, the bank would still be able to recover the money given by seizing the collateral. But not just that, before the bank even considers giving out the loan, they have to also check the creditworthiness of the businessman. This is to ascertain he is good for it and most likely wouldn’t default. They basically look at financial state, credit reports, and business cash flows.

Lenders also look at the credit score of borrowers, which is a number that shows the creditworthiness of the borrower. A higher credit score means lower risk to the lender and a better chance of the borrower getting the loan.

In DeFi lending and borrowing, it’s a bit different. Crypto borrowing in DeFi allows individuals to take loans in cryptocurrency or stablecoins using their digital assets as collateral. Unlike traditional finance, DeFi operates on decentralized platforms built on blockchain technology, eliminating the need for intermediaries such as banks in facilitating loans. Smart contracts automate the borrowing and lending processes, ensuring transparency and security for all parties involved. Creditworthiness is checked in DeFi lending as they mainly rely on collateral, meaning anyone can borrow funds as long as they provide sufficient collateral, regardless of their traditional credit history.

Here’s how it typically functions:

Lending: Lenders supply assets (often cryptocurrencies) to liquidity pools, earning interest over time. The interest rates are determined by supply and demand dynamics within these pools. When lenders add their assets to the pool, they provide the liquidity needed for borrowing.

Borrowing: To borrow assets, individuals must provide collateral—typically worth more than the amount they intend borrowing—to mitigate risk. This over-collateralization is crucial due to the volatility of crypto assets and the lack of traditional credit assessments. Borrowers can then obtain loans in different cryptocurrencies, which they can use for various purposes without selling their original assets.

Smart Contracts: These self-executing contracts automate the entire lending process, ensuring that terms are adhered to without requiring human intervention. It manages everything from interest calculations to collateral liquidation if a borrower fails to repay.

Issues with DeFi lending

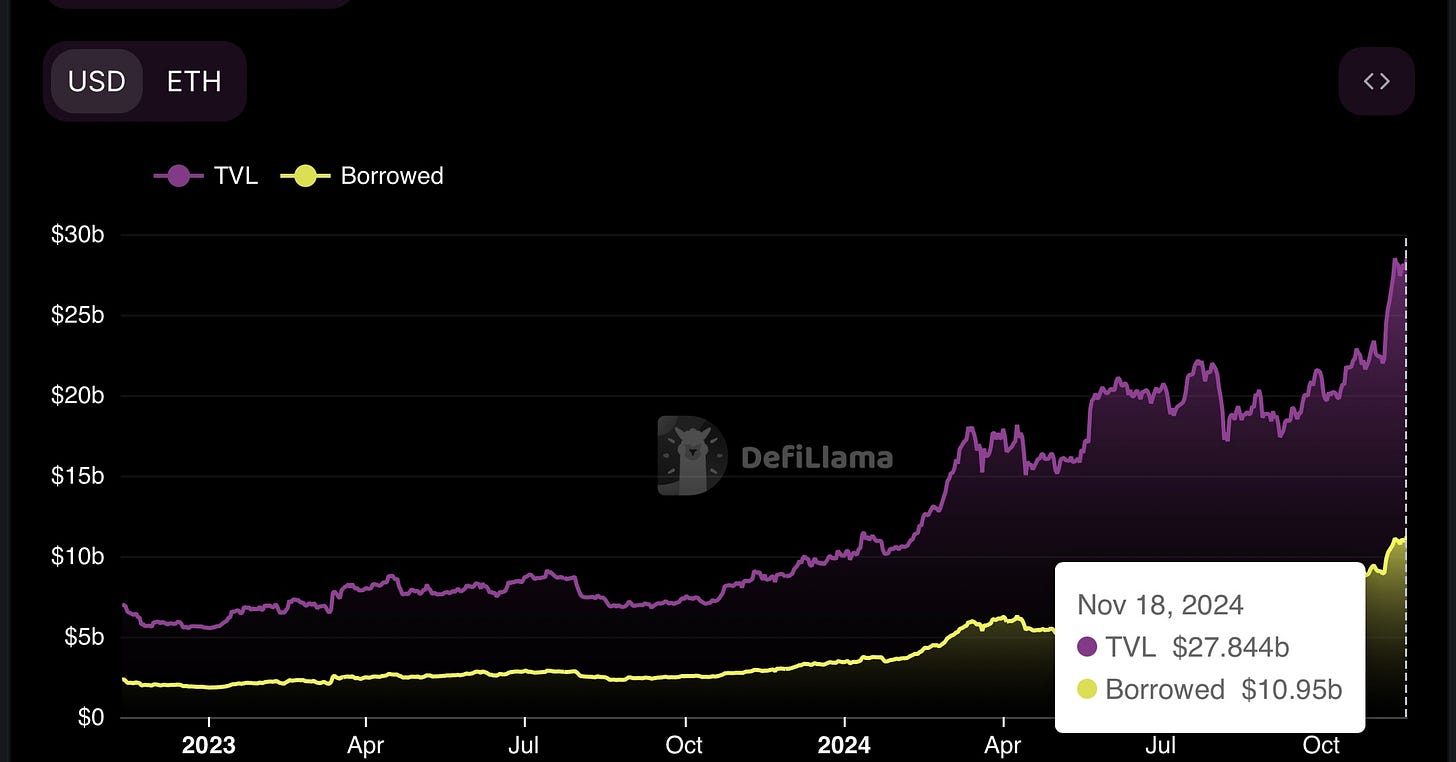

As of the time of writing, the total amount borrowed in DeFi as shown on the charts is significantly low compared to traditional finance. This is due to the high collateral requirements of most DeFi lending protocols and the volatility in crypto assets, which can increase interest rates.

So one may wonder why then choose to over-collaterize? When platforms like AAVE and MakerDao require borrowers to deposit at least 150% of cryptocurrency collateral that exceeds the loan value they intend taking. So say I want to borrow 7.5 ETH; I’ll have to pledge about 10 ETH as collateral.

Borrowers accept overcollateralization in hopes that when the loan is given, they can use it to get another crypto asset, which they may believe would go up in value. Instead of selling the crypto assets they own to buy a new one, they take out loans as leverage to buy the new tokens. When it actually goes up in value, they sell it, pay back the loan, keep the profit made and get back their crypto collateral.

But with the volatility in crypto, this scenario is not guaranteed. Also, over-collateralization protects lenders from the high volatility of crypto assets, ensuring that the loan is secured by more valuable collateral than the borrowed amount.

So lenders are always protected but how about the borrower?

Because of the volatility of crypto assets, when used as collateral, if there’s a decrease in the value of the asset pledged beyond the predetermined threshold set by the DeFi lending protocol, it issues a margin call requesting borrowers deposit additional collateral. If they are unable to meet the margin call, the smart contract executes partial or full liquidation of the assets with any outstanding interest to protect the lender. This leads to a significant loss for the borrowers as his collateral is sold off at a discount to repay the loan.

Stablebonds as Collateral

In tradFi, government bonds have long been in use as collateral to secure loans. This is due to their low risk, which stems from being backed by national governments, making them attractive collateral options for lenders. The banks love them because of their high liquidity, as they can easily be sold off as opposed to other collaterals such as real estate.

Stablebonds being utilized as collateral in DeFi lending can provide the same loan security experienced in traditional finance. Being that they are also backed by stable government assets, it wouldn’t unnecessarily fluctuate in price. This would lower the collateralization ratio required for loans, making borrowing more attractive, as borrowers would need to pledge less collateral or the same value equal to the loan needed compared to volatile cryptocurrencies, which require higher pledged collateral on DeFi lending platforms.

Lenders experience reduced risk when accepting stablebonds as collateral. The stability of these bonds provides a more predictable value. Lenders in DeFi are certain about the value of the collateral deposited, eliminating price speculation and knowing that when the loan is being repaid it hasn’t reduced in value.

The use of stablebonds as collateral decreases the frequency of liquidations during market downturns. DeFi lending protocols don’t have to set a liquidation threshold, as stablebonds maintain a set value. This stability helps maintain liquidity in lending pools, as fewer forced liquidations mean less disruption to the overall market. Loans can span from a few days to months without fail of liquidation based on volatility of crypto assets, especially during a bear market.

Borrowing and lending in DeFi depends on the size of the liquidity pool of asset pairs. This pool relies on users to provide such liquidity—the acceptance of stablebonds—not just as collateral draws more capital into the DeFi lending pool.

The backing of stablebonds by reliable government assets can attract more conservative investors to DeFi platforms, increasing the overall liquidity available for lending and borrowing, which in turn increases confidence for lenders.

Also, stablebonds offer competitive yields, further incentivizing liquidity provision. This influx can improve the efficiency and depth of these markets.

Future Implications and Challenges

Though Stablebonds are a much-needed innovation in DeFi lending. This doesn’t exempt it from certain risks, being that these are tokenized assets of government bonds.

The risk involved in investing in traditional government bonds and accepting them as collateral may also plague stablebonds. If a government defaults on bonds that back certain stablebonds, the value of those stablebonds would be affected adversely. Such a situation could lead to increased volatility and potential de-pegging from their intended value, posing risks for users who have pledged them as collateral.

Following a default, the perceived risk associated with government bonds rises sharply. This leads to increased yields on new bonds, which subsequently raises borrowing costs for borrowers who rely on these bonds as their collateral. As interest rates rise, the cost of securing loans also increases, making it more expensive for borrowers to access capital.

If the value of government bonds drops significantly post-default, borrowers who have used these bonds as collateral may face liquidation risks. Lenders may liquidate the collateral to recover their funds if the bond value falls below a certain threshold, potentially leading to substantial losses for borrowers.

That’s why Etherfuse has taken the time to vet and handpick government bonds from countries with stable economies with a record of not defaulting on their bonds to back its range of stablebond offerings.

Conclusion

Stablebonds as collateral benefit both lenders and borrowers in DeFi. Combining the stability of government-backed assets with the advantages of blockchain technology. Their adoption could lead to a more secure, accessible, and sophisticated DeFi ecosystem, bridging the gap between traditional finance and decentralized finance. By leveraging Stablebonds, DeFi platforms can enhance their offerings, reduce risks, and attract a broader user base, ultimately contributing to the maturation of the DeFi sector.

Reference

Bonds: definition, how they work, terms, type

A Brief History of Bond Investing

DeFi Lending and Borrowing: A Beginner's Guide

DeFi liquidations: Volatility and liquidity

Risks associated with government bonds